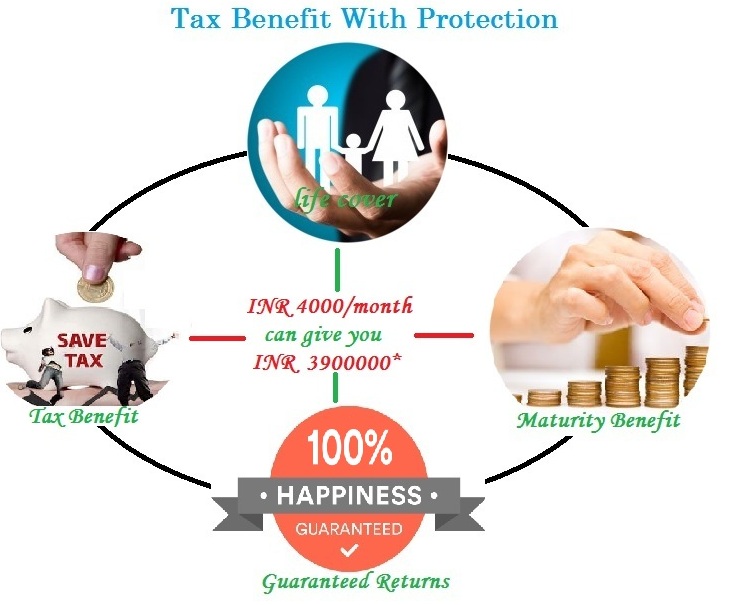

Investment insurance plan is an instrument that acts like an investment tool and provides you benefits of a life insurance plan simultaneously.

Simple reasons to buy investment insurance plans:

- You can make goal-based investment i.e. investments can be made keeping educational needs, marriage, retirement needs or for a business venture

- You get peace of mind that your dependants will be taken care of when you will not be around them any more

Take a look at the roles we are currently recruiting for below. If you have any questions, feel free to contact us at contact@rightensure.com

How do pension plans work?

Any investment insurance plan fulfills two basic requirements i.e. investment as well as insurance. Therefore, when you acquire an investment insurance plan, a part of your funds are used to provide you life cover while the rest of the part is invested in financial instruments of your choice.

The best investment insurance plan lets you utilize your savings in a systematic and planned way. You are able to choose the number of years for which you want to make an investment. Also, you are able to choose the kind of instruments you want to invest in as per your risk appetite.